Introduction

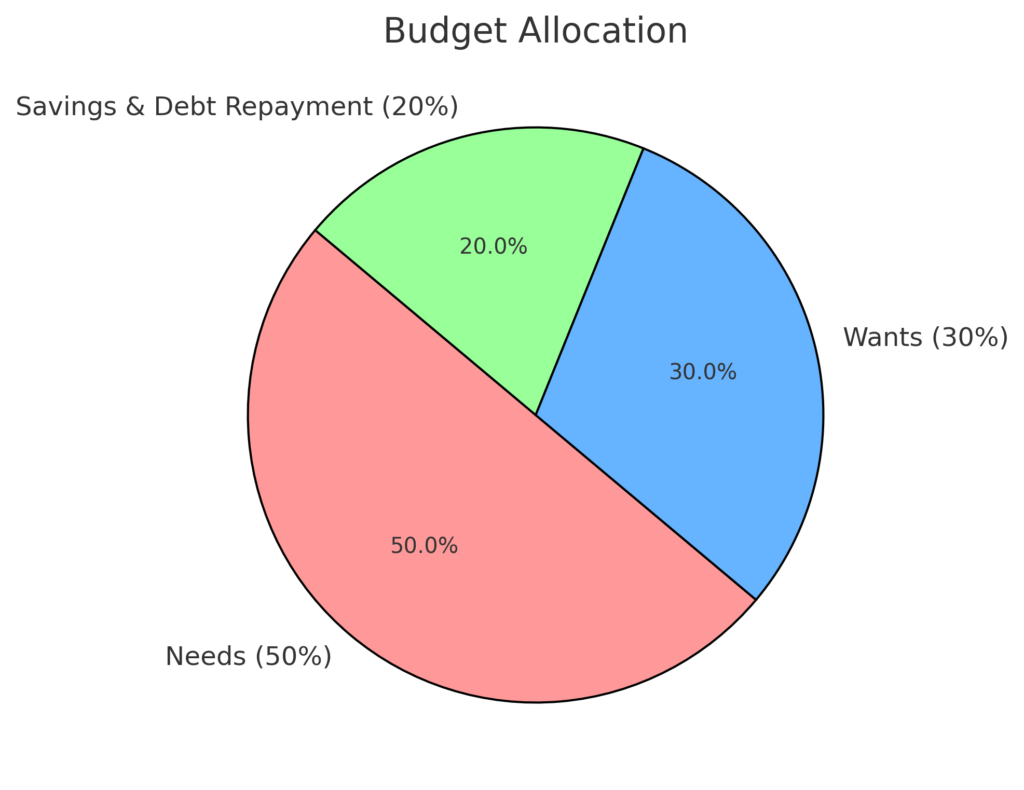

Managing personal finances can feel overwhelming, but with the right budgeting method, anyone can take control of their money. One of the most popular and easy-to-follow budgeting strategies is the 50/30/20 rule. This simple rule divides your income into three categories: Needs (50%), Wants (30%), and Savings & Debt Repayment (20%). In this guide, we’ll break down the 50/30/20 rule, explain how to apply it, and provide tips to make it work for you.

What is the 50/30/20 Budget Rule?

The 50/30/20 rule was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan. The idea is simple: you allocate your after-tax income into three broad spending categories:

- 50% Needs: Essential expenses you cannot avoid.

- 30% Wants: Non-essential but enjoyable expenses.

- 20% Savings & Debt Repayment: Future financial security.

This approach simplifies budgeting while ensuring that you meet financial obligations, enjoy life, and secure your future.

Breaking Down the 50/30/20 Rule

1. 50% for Needs

The first half of your income goes towards essentials—expenses that you must pay to live a stable life. These include:

- Rent or mortgage payments

- Utilities (electricity, water, internet, gas)

- Groceries

- Health insurance

- Transportation (car payments, fuel, public transport)

- Minimum debt payments (credit cards, student loans)

2. 30% for Wants

This category is for things you want but don’t necessarily need. It’s important to enjoy your earnings while keeping spending in check. Wants include:

- Dining out

- Entertainment (movies, concerts, subscriptions)

- Shopping (clothes, gadgets, accessories)

- Travel and vacations

- Gym memberships or hobbies

3. 20% for Savings & Debt Repayment

The final portion of your budget is dedicated to securing your financial future. This includes:

- Emergency savings

- Retirement contributions (401k, IRA, etc.)

- Paying off debt beyond the minimum amount

- Investing (stocks, mutual funds, real estate)

To make savings easier, consider using a budget planner or finance book to track your expenses and goals. Check out this highly-rated budget planner on Amazon to help you stay on top of your finances.

How to Apply the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

Your after-tax income is what you take home after federal, state, and local taxes. If you’re an employee, it’s your paycheck amount. If you’re self-employed, deduct business expenses and taxes to find your true take-home pay.

Step 2: Allocate Your Income

Let’s say your monthly after-tax income is $4,000:

- Needs (50%) = $2,000

- Wants (30%) = $1,200

- Savings & Debt Repayment (20%) = $800

Step 3: Track Your Expenses

Use budgeting apps like Mint, YNAB, or Empower to track your spending. Categorize expenses under needs, wants, and savings to stay on track.

Step 4: Adjust as Needed

If your needs exceed 50%, adjust your wants or find ways to cut essential costs. Similarly, if you’re not saving enough, reduce unnecessary expenses.

Benefits of the 50/30/20 Rule

✅ Simple & Easy to Follow – No need for complex spreadsheets. ✅ Ensures Balance – Covers essentials, lifestyle, and financial growth. ✅ Encourages Saving – Helps build emergency funds and investments. ✅ Flexible – Can be adjusted based on personal goals and income

Common Challenges & Solutions

1. High Living Costs

- If rent and utilities take up more than 50%, cut discretionary spending or look for cheaper alternatives.

2. Irregular Income

- If self-employed, average out past months’ income and adjust categories accordingly.

3. Debt Burden

- Prioritize high-interest debt in the 20% savings category to become debt-free faster.

Final Thoughts

The 50/30/20 budget rule is a fantastic starting point for anyone looking to manage their finances effectively. It provides structure while allowing flexibility for personal needs and goals. By consistently following this budgeting method, you can enjoy financial stability, peace of mind, and long-term wealth-building.

💡 Remember: Budgeting isn’t about restriction—it’s about smart money management. Start applying this rule today and watch your financial confidence grow!

To make budgeting easier, consider using a budgeting book or planner to stay organized. Check out this recommended budgeting book on Amazon to get started.

📚 Recommended Reading

Want to dive deeper into budgeting and financial freedom? Check out this highly recommended book:

📖 The Total Money Makeover by Dave Ramsey – A step-by-step guide to budgeting, saving, and achieving financial success.

FAQ: Common Questions on the 50/30/20 Rule

Q: Is the 50/30/20 rule suitable for low-income earners?

A: Yes, but you can adjust the percentages based on your situation (e.g., 60/20/20).

Q: What budgeting apps can help track my spending?

A: Apps like Mint, YNAB, and PocketGuard make following the rule easier.

🚀 Start your budgeting journey today and take charge of your financial future!

Leave a Reply